Keren Hayesod’s Impact Fund is the world’s primary fund for investors seeking to maximize impact for the people and future of Israel. Since 1920, Keren Hayesod has served as the global leader in Israel-oriented philanthropy. Now, through our Impact Fund, investors passionate about Israel, its people and its future can leverage their expertise and assets for maximum positive social change. The KH Impact Fund allows investors worldwide to use business tools to generate impact and solve Israel’s most pressing issues. We champion sustainability, scalability and transparency. Together, we are unleashing the unlocked potential by combining business principles with impact goals in Israel.

Let’s talk!An Impact Investment Fund for the People of Israel

Keren Hayesod’s Impact Fund is the world’s primary fund for investors seeking to maximize impact for the people and future of Israel. Since 1920, Keren Hayesod has served as the global leader in Israel-oriented philanthropy. Now, through our Impact Fund, investors passionate about Israel, its people and its future can leverage their expertise and assets for maximum positive social change.

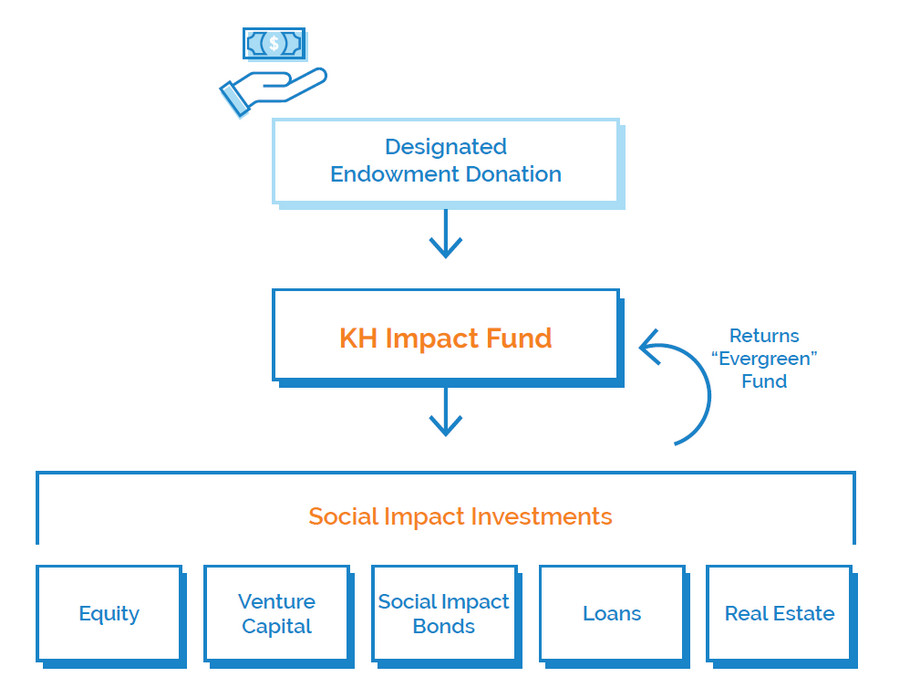

- The KH Impact Fund is the first endowment fund of its kind in Israel and is on the cutting-edge of social investment and philanthropy in Israel.

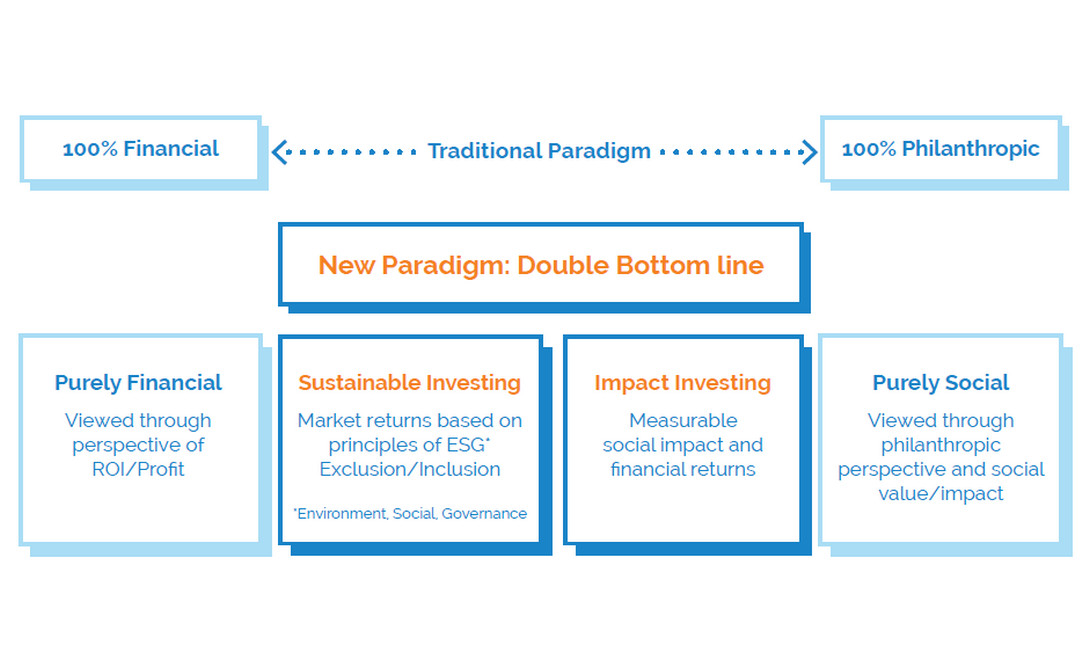

- Impact Investment is a new paradigm in the world of Philanthropy, combining a social impact with financial return – in what is termed a “double bottom line”.

- The KH Impact Fund enables donors to take part in this exciting new field by contributing to a fund that will invests 100% of its capital in Impact Investment assets in Israel.

- In addition to creating the social impact that traditional philanthropy generated, and a viable source of income for these social enterprises

- the Fund aims to generate returns that will enable an evergreen investment/philanthropic cycle.

- A donations/investment of US $25,000 will give you the opportunity to join the Fund and take an active role in shaping the investment portfolio as a member of the Fund’s Investment Committee.

- The Fund is managed according to strict legal and fiduciary standard as part of the Keren Hayesod Global Endowment Fund.

- The Fund is advised by Social Finance Israel, the leading professional not-for-profit organisation in Israel in the field of Impact Investment and a

member of the Social Finance Global Network.

Impact Investment is an emerging and fast developing approach to creating social change. If in the past, we strictly differentiated between investments and philanthropy and between financial returns and social impact, today there is a new paradigm that combines these elements. Impact Investing creates a continuum that stretches between “purely financial” investments and “purely philanthropic” donations (Fig. 1), with many different options in between that combine both and generate a “double bottom line”.

As a donor/investor, including Impact Investing as part of your philanthropy provides you with the following advantages:

1. A new exciting approach:

While government funds and philanthropic grants are still vital to deal with serious social challenges, combining them with Impact Investing is a new and exciting approach. This combination is viewed by many as a more long-term and sustainable method to solve long-standing social issues (Fig. 2).

2. Results are measurable:

The two characteristics of Impact Investing are intention (social impact is intended), Measurement (the social outcome is measurable).

As a “traditional” donor you can receive detailed reporting regarding input and output, which can indicate the degree of impact. The nature of Impact Investing, which involves returns and proof of outcome, demands a much greater level of measurability and accountability.

3. Thinking and acting like a business:

To be eligible for receiving Impact Investment funds, NGOs have to develop business-like elements in their work that will generate the required “double bottom line”: social and financial outcomes. This way of thinking, and implementing these concepts requires the not-forprofit organisations to integrate into their operations business ways of thinking and acting. While it is important that these organisations do not lose their social spirit, expertise and compassion – adding on a target-oriented perspective – can lead to good things. In addition, it can help with finding more sustainable funding solutions and scaling them up as this new resource pool is tapped into.

4. Evergreen philanthropy:

Impact Investing, through the perspective of an endowment and a social impact-first approach, may not yield returns to you as an investor, but will enable your donation to multiply its impact. Assuming that the investment succeeds financially, every few years, your philanthropic investment will be returned into the endowment, hopefully with additional earnings, to be reinvested on an ongoing “evergreen” basis.

The KH Impact Fund is a new philanthropic tool designed to enable donors who wish to be part of this new emerging field and generate social impact in a different way. The Fund, which will be part of the legal and financial structure of the Keren Hayesod Endowment Fund, is available for philanthropic investments (minimum of US $25,000) that will be invested 100% in social impact investment initiatives.

A contribution, based on a KH endowment agreement, will entitle the donors to all the relevant tax benefits available from their local KH campaign and will be allocated to the Impact Fund. Each US $25,000 investment to the Fund will also entitle the donor to one vote on the Fund’s Investment Committee. The Investment Committee will review Israeli impact investment opportunities, which will be selected, analysed and evaluated by Social Finance Israel experts. The Committee will determine the investments according to the Fund’s investment policy and the recommendations of an Advisory Board. All returns and earnings will be reinvested in the Fund, creating an “evergreen” endowment.

“The merits and achievements of Keren Hayesod are engraved in the soil of the homeland and treasured in the soul of the nation.”

David Ben-Gurion

Impact Investment asset classes are varied and correlate with what the regular financial markets have to offer. Although most Impact Investments are predominantly based on social loans (according to UBS global investment bank data, they represent over 35% of global impact assets), a variety of other tools are available, ranging from private equity in social business to social venture capital, real estate investments and social impact bonds (SIBs). As the end result of these investments is solutions to social problems, this market can bring together public sector budgets, philanthropic funds and private and institutional investment funds – enabling innovative blended finance structures. In Israel, even though the Impact Investing market is just starting to evolve, all asset classes are available and will be considered for investment by the KH Impact Fund.

Investment strategy and policy

The KH Impact Fund will invest 100% of its capital in Impact Investments based on the following guidelines.

Fields of activity for investment: The Fund will invest in impact investments in fields of activity that correlate with the agenda and activities of Keren Hayesod, such as strengthening Israel’s periphery, assisting vulnerable population and youth at risk and Aliyah and absorption.

Recipients: The Fund will invest in not-for-profit organizations and profit enterprises in Israel which aim to generate financial returns and a meaningful and measurable positive social impact.

Investment Criteria: All investments will intend to achieve a positive financial return, based on “patient” or high-risk capital, but social impact will have priority over pure financial return considerations.

Forms Assets: Investment will be permissible in a variety of financial tools, including Senior and Subordinated loans; Pay-for-success instruments; Private equity (limited to 20%); Guarantees; Deposits and Cash and Cash Equivalents.

General principles and Risk Mitigation:

- Minimum investment: US $200K

- Maximum investment: US $300K

- Diversification: investments over a spectrum of themes and asset classes.

- Partners: priority to co-investments with other partners.

- Investee assessment: programmatic and financial analysis will be conducted.

- Currency: investments will be made in NIS

- Reinvesting: any returns on investment will be reinvested as part of the Fund.

Governance and the Investment Committee:

- The Fund will be part of the Keren Hayesod Global Endowment Fund.

- Minimum donation to join the Fund – US $25K

- The Fund will be governed and decided by the Fund’s Investment Committee.

- Each donation amount of US $25K will grant one (1) vote in the Investment Committee.

- The Committee will meet once every 6 months to review the Fund’s progress and make necessary investment decisions.

While, as stated above, the Impact Investment market in Israel is just starting to evolve, there is already a wide variety of investment opportunities that span all assets classes. The following are just a few examples to give an idea of the type of investments the Fund will be reviewing:

Subject and social need

A not-for-profit public organisation, which develops tools to improve the lives and increase the life expectancy of elderly people and those with disabilities.

Purpose

Financing the initial production of the electronic device which was developed by the organisation to enable people with cognitive decline (dementia) to find everyday objects in their home. Market research found strong demand for the device (estimated world total market potential is over US $33bn).

The Loan

- A loan of $145K is requested in two installments

- 10 monthly payments (interest + principal)

- 1.6% rate of interest

- Receipt of equity in the venture will be possible if the company becomes commercial.

Social Impact Bond: Reducing Recidivism

Subject and social need

43% of 6,500 prisoners released annually are expected to return to prison within 5 years of release. This high recidivism rate is one of the primary unsolved social issues worldwide with extensive social and economic implications. The intervention program 500 participants overall, from 3 prisons will receive up to two years of intensive intervention, including: vocational training, workshops, group and individual sessions and assistance in ad hoc issues. Measurement Reincarceration rates 4 years post release, compared to predicted incarceration rates.

The Bond

- Outcome payers: The Ministry of Public Security

- Investment terms: 8 years (semi annual draw-down)

- Repayments: Pay-for-Success, beginning at the end of the fifth year

- Target return: Projected returns annualised IRR 6.4%, Cap annualised IRR 13%

Youth Village – Energy Efficiency Initiative for Youth At-Risk

Subject and social need

Youth Villages have an impact on thousands of lives of youth at-risk.

Purpose

To finance the village’s energy efficiency program, leading to savings in current expenses that will be channeled for social and educational purposes.

The Loan

- US $250K for the installation of the solar system

- result in net annual savings of up to US $30K

- Repayment: 10 years – monthly payments (interest + principal),

- an annual sum of US $27K

Social Loans for Small Businesses

Subject and social need

To enable Israelis without sufficient means to open small businesses or expand existing ones.

The Loan

- A loan of US $250k to be executed through a Social Loan Bank

- Monthly payments of interest to be paid on utilised capital, and principal to be repaid in lump sum after 9 years.

- Investment period: 9 years

- Annual interest rate: 0.5%-1%

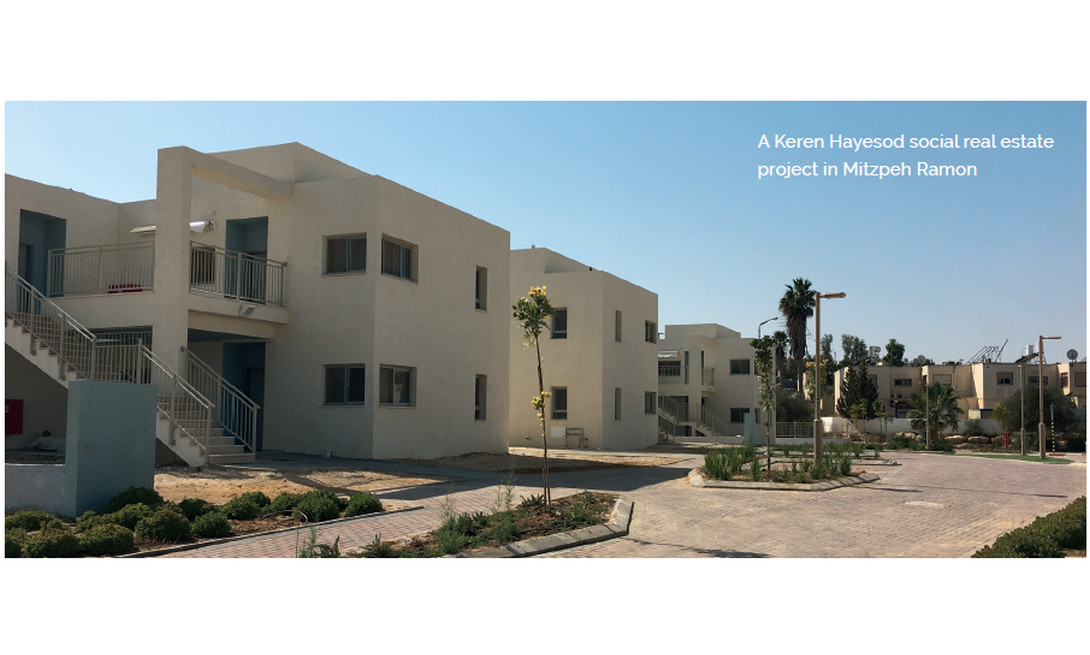

Social Real Estate: Affordable Housing for the Periphery

Subject and social need

Working to fulfill the potential of the Negev and Galilee, in regards to population, social progress, economic prosperity, and infrastructure. The strategy is working to transform the periphery with an all-encompassing, inviting and motivating housing process, accelerating the integration of new families in those regions.

Purpose

Construction of 303 units (46 rentals) in Sderot will take place between the first quarter of 2019 and the end of 2021. Total cost of project – US $81M. Equity investment – US $10M. Total estimated revenues – US $90M.

The Investment

- Project Finance of US $250K

- Investment period: 10 years – first distribution after 5 years, second distribution after 10 years.

- Target return: Target IRR 5%

“Of the eight levels of TZEDAKAH the highest is that of assisting the poor with a loan or a partnership to enable them to provide for themselves – help them until they no longer need the assistance of others”

Maimonides

Keren Hayesod – UIA has been at the forefront of Israel’s growth and progress for close to a century. Founded in 1920, we are the preeminent worldwide fundraising organisation for the People of Israel. Keren Hayesod is recognised today as a National Institution (Public Benefit Company) with special legal status, according to the Knesset’s Keren Hayesod Law of 1956. Keren Hayesod operates fundraising campaigns in over 46 communities around the world, operates in 9 languages and serves as a strong global network. Keren Hayesod upholds strict auditing, legal and financial standards. It is guided by a fiduciary responsibility to its donors and operates within a strict auditing environment, based on Israeli and international regulatory requirements. Keren Hayesod is governed by our Board of Directors and World Executive. Our Board represents our partnership with the broader Zionist movement, while our World Executive is composed of senior leaders from different campaigns around the world. Keren Hayesod, which is a non-political not-forprofit entity, has strong ties of cooperation with many strategic partners in Israel, including the Jewish Agency for Israel, the Government of Israel and hundreds of Israeli municipalities and NGOs. The professional headquarters are in Jerusalem, which provides services to our campaigns around the world, based on unparalleled experience and deep knowledge of Israel, its establishments, national priorities and social needs.

For further details

Keren Hayesod – United Israel Appeal

48 King George St. P.O.B 7583,

Jerusalem 91074

Tel: +972-2-6701802

Fax: +972-2-6702023

E-Mail: [email protected]

Mobile:

Dani: +972-50-6232524

Yaacov: +972-2-6701868

Anat: +972-50-6385114

This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings.

If you disable this cookie, we will not be able to save your preferences. This means that every time you visit this website you will need to enable or disable cookies again.